Maintaining the financial fitness of your business is one of the most important elements of operating a successful enterprise. There are few skills as critical to running a business as budgeting. Yet, over half of the executives surveyed in a 2019 McKinsey study report felt dissatisfied with the transparency surrounding their organizations’ budgets.

Let’s discuss the importance of mastering budgeting as a tool to help manage your business to achieve the results you want.

What Is Budgeting and Why It Matters

In its simplest form, a budget is a roadmap for your business based on expected revenues and expenses, typically for one year. It’s driven by the business goals established in your Annual Plan and identifies the financial resources required to achieve your objectives. A budget can help you plan your business activities and can act as a yardstick for setting up financial goals.

A budget generally consists of projected revenues and expenses for a given period (for instance, the upcoming quarter or year). After expenses are subtracted from projected revenues, the remaining profit can be distributed to the owners or allocated to new projects and investments.

Budgets should be compared to the company’s actual financial performance each month to determine if the enterprise is on or off track, leading to potential actions to ensure the achievement of your goals.

For example, you budgeted $10 million for your company’s annual revenues but your actual performance is forecasted to run $1 million short of your budget. With that information, your management team may need to examine and reprioritize activities such as:

- Determine why you have a revenue shortfall and what actions need to be taken to make up the shortfall.

- Evaluate other projects to reduce expenses to achieve the profit budget.

That’s why budgets matter. They can be used as a management tool to provide information to track progress, help make decisions and drive accountability for the results you want for your business.

Steps in Mastering Budgeting

Types of Budgeting

Start by determining the type of budget that fits your organization. Several types of budgeting methodologies can be used based on the company and situation. Three common types include:

- Static budgeting, or incremental-based budgeting, uses historical data to add or subtract a percentage from the previous period to create the upcoming period’s budget.

- Zero-based budgeting, which sets each budget line item at zero dollars at the start of the period and is built from the bottom up.

- Activity-based budgeting starts with the company’s goals and works backward to determine the cost of attaining them.

For example, if your organization is in financial distress, the zero-based method may be the best fit, as it starts from scratch each period. Static-based budgets may be best for stable, low-growth companies.

Steps to Create A Budget

At its core, budgeting’s primary function is to ensure an organization has enough resources to meet its goals. Therefore, developing your Annual Plan for the year should be completed before you create your budget. The Annual Plan goals should drive the budget by identifying priorities for the coming year.

The primary component of a budget is a proforma profit & loss statement (P&L) for your business. Let’s review the budget process to help you get started.

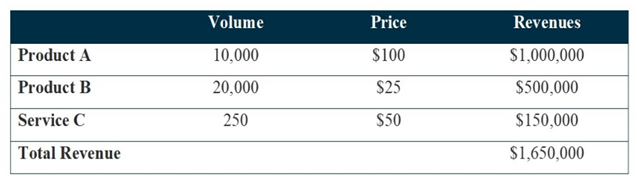

Step 1 – Forecasting Revenues

The first step is usually forecasting the organization’s revenues. Creating a revenue model for your business can be very helpful. If your company sells products, it may consist of projecting the volume of units sold at a certain price. For example, revenue is generated by selling X number of widgets at Y price per widget. If you have a service-related business, you may estimate the number of customers or projects, along with an average dollar amount for each transaction. For example, if you sell software on a subscription basis (SaaS), revenue is generated by X number of paid users at Y subscription price per month multiplied by 12 months. See the following revenue model example.

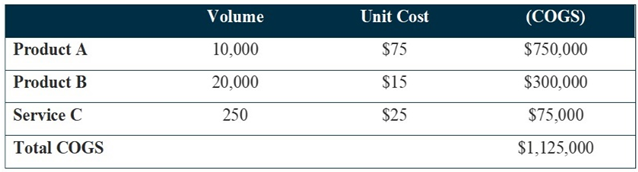

Step 2 – Determining Cost of Goods Sold

Determine the cost to produce your product or services (Cost of Goods Sold). Determine the direct (or variable) expenses for producing your product or services such as materials, supplies and labor. These expenses can be calculated on a unit-cost basis. For example, if your company produces wooden chairs, identify how much wood, stain and labor hours are needed to produce each chair. Labor may include cutting, finishing, assembling and shipping each chair. Identify your fully loaded Labor Rate, which includes wages, payroll taxes, benefits and health care expenses. Don’t forget to calculate your Labor Efficiency Rate, which is the amount of time working divided by the number of paid hours. See the following cost model example.

Step 3 – Identifying Your Overhead Expenses

Identify your Overhead and Fixed Expenses for your budget. These are expenses that don’t necessarily vary by the volume of products produced. It includes executive, sales and staff salaries, marketing, facilities, equipment, insurance and so on. Of course, at some level, you may need to increase these fixed expenses if you grow. It’s important to understand Overhead Expenses so you can allocate these costs when you price your products or services. There are many ways to allocate these based on volumes, Cost of Goods Sold expenses or some other volume-related methodology.

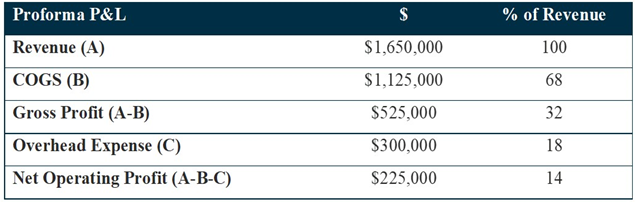

Step 4 – Net Operating Profit

After completing Steps 1 – 3, the remaining difference will be your Net Operating Profit (or Loss). Is the remaining balance aligned with your expectations and goals? If not, you may have to review each step to see where you can help improve your bottom-line results. The chart below is a simplified summary of the budget.

Reviewing and Managing Your Budget

The final step in the budgeting process is the most important. You need to use the budget as a tool to make resource and financial decisions to manage your company. You can use the budget to set company-wide and team goals and track progress to help drive focus and accountability. It helps prioritize projects by considering the potential Return on Investment (ROI) for each project, along with how each aligns with your company’s broader goals.

If you work at a startup or are considering seeking outside investors, it’s important to have a documented budget. When deciding whether to fund a company, investors value its current, past and projected financial performance. Providing documents for previous periods with budgeted and actual spending can show your ability to handle a company’s finances, allocate funds and pivot when appropriate. Some investors may ask for your current budget to see your projected performance and priorities.

Using the Budget to Manage Your Business

The budget is a financial roadmap for the upcoming period. If all goes according to plan, it shows how much should be earned and spent on specific items. But we all know the business world is often unpredictable. Circumstances outside your control can impact your revenue or cause priorities to change at a moment’s notice.

Consider the onset of the coronavirus (COVID-19) pandemic in 2020. The economic impact of travel bans, lockdowns and other safety precautions was far-reaching and unexpected. Executives were forced to quickly—yet thoughtfully—rework budgets to account for major losses and newfound safety concerns.

A budget gives you a plan but maintaining an agile perspective helps you pivot and lead your organization through turbulent times. Planning for contingencies is an important step in the budgeting process and overall risk management.

Therefore, regular monitoring of your actual financial performance compared to your budget is essential to managing your business and minimizing surprises. I recommend monthly budget reviews and analysis to identify potential issues before they become big problems. Developing Key Performance Indicators (KPIs) to monitor leading indicators can be extremely valuable. For example, monitoring prospective sales leads can give your team an indication of future sales. Evaluating your Accounts Receivable Aging can indicate future cash flow issues.

Developing this review rhythm for your business also drives accountability for results. It was Tom Peters, the author of In Search of Excellence, who said “What gets measured gets done.”

Conclusion

Hopefully, we’ve demonstrated that mastering budgeting is a critical process for your business to help manage resources and achieve your goals. Building a budget doesn’t have to be a monumental effort and the steps in the process previously laid out can help you establish a simple plan that you can manage. The key to a successful budget process is to incorporate regular reviews and analysis so you can prioritize resources and make good decisions to help you maintain the financial fitness of your business.